What is E-way Bill?

GST E-Way Bill is a recently announced system for keeping a track of goods in transit introduced under the Goods and Services Tax. Any taxable person registered under Goods & services tax and causing movement of consignment with the worth of more than Rs.50,000 is obligatory to produce a GST E-Way Bill through the GST Common Portal. The GST [Goods and service tax] E-Way Bill is a document that is announced under the GST [Goods and service tax] plan for any sort of goods transport of load worth more than 50,000 Rupees.

The E-Way bill Portal

E-way bill portal puts forward a seamless access for:

- Generating e-way bills

- Changing the vehicle number on the E-Way Bill that is generated beforehand

- cancel generated EWBs

E-way bills in EWB-01 can easily be generated through Web or Via SMS.

Given below are the steps to generate E-Way Bill through the waybill portal:

- Registration on the EWB portal

- The Challan, invoice or bill linked to the consignment should be in hand.

- In case of road transport, you should have the transporter ID or Vehicle number.

- And, in case it is transported by rail, ship, or air then you must have the transporter ID, Transport document number together with the date on the document.

Here is a step by step Guide to Generate E-Way Bill (EWB-01) online:

Step 1- Login

Login to e-way bill system and fill up the required fields such as username, password & Captcha and login.

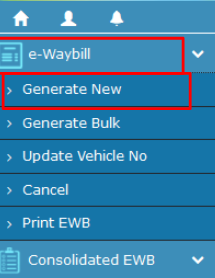

Step 2- Generate

Click on the tab ‘Generate new’ given under ‘E-waybill’ option on the dashboard’s left side.

Step 3- Fill the details

Fill up the following details on the screen that appears:

1.Transaction type: Select (outward) for consignment supplier and Select (Inward) for consignment receiver.

2. Choose the suitable sub-type

If transaction type selected is Outward, following subtypes appear:

If transaction type selected is Inward, following subtypes appear:

If transaction type selected is Inward, following subtypes appear: Step 3- Choose the document type : such as Invoice, credit note, Bill, Bill of entry, challan, etc.After that, Enter the invoice/document number choose the date of Document, challan or Invoice (the user will not be permitted to select future date)

Step 3- Choose the document type : such as Invoice, credit note, Bill, Bill of entry, challan, etc.After that, Enter the invoice/document number choose the date of Document, challan or Invoice (the user will not be permitted to select future date)

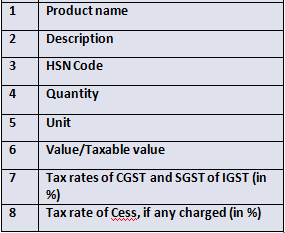

Fill up the to and from details accordingly.  The next step is to add consignment details such as description, Value/Taxable value, HSN Code, Product name, Quantity, Tax rates of CGST and SGST or IGST (in %), Unit, Tax rate of Cess if any charged (in %)

The next step is to add consignment details such as description, Value/Taxable value, HSN Code, Product name, Quantity, Tax rates of CGST and SGST or IGST (in %), Unit, Tax rate of Cess if any charged (in %)

Transporter details:

Transporter details:

Now, you need to fill up the correct mode of transport together with the estimated distance in KM. (Please note that these are mandatory to be filled here.)

Other than the above details, any of these can be mentioned among the transporter name, transporter Doc. No. & Date, transporter ID.

Other than the above details, any of these can be mentioned among the transporter name, transporter Doc. No. & Date, transporter ID.

Submit the details

The system authenticates the data filled and shows an error if any. Or else, the request gets processed and the e-way bill in EWB-01 form having a unique 12 digit figure is generated.

The e-way bill generated looks like this:

Generating the E-Way Bill

The GST E-Way Bill can simply be produced by the aid of GST Common Portal by a tax paying an individual who is registered with the GST, an individual who is not registered or some transport service provider. On the submission of required credentials for the GST Common Portal in FORM GST INS-01, a unique EBN (e-way bill number) would be given to the provider, the receiver and the transporter as well.

In case a taxable person who is registered under goods and service tax does not make a statement of acceptance or rejection within the duration of 3 days of the information provided regarding the GST Common Portal, then the Bill would be taken as accepted. As a final point, all the accepted GST E-Way Bills would be prepared to accept mechanically on the GSTR-1 at the time of filing monthly GST Returns.

Any tax paying an individual who is registered would be informed about the matter of a GST E-Way Bill or E-way bill number on the common GST portal. The registered person would hold the choice to agree with or refuse the shipment covered under the e-way bill.

In case an unregistered person creates an E-way Bill, then the status of Bill would be texted to the registered contact number or else to the registered email address of the unregistered person.